StormX (STMX) Price Surge Triggers Market Manipulation Worries

[ad_1]

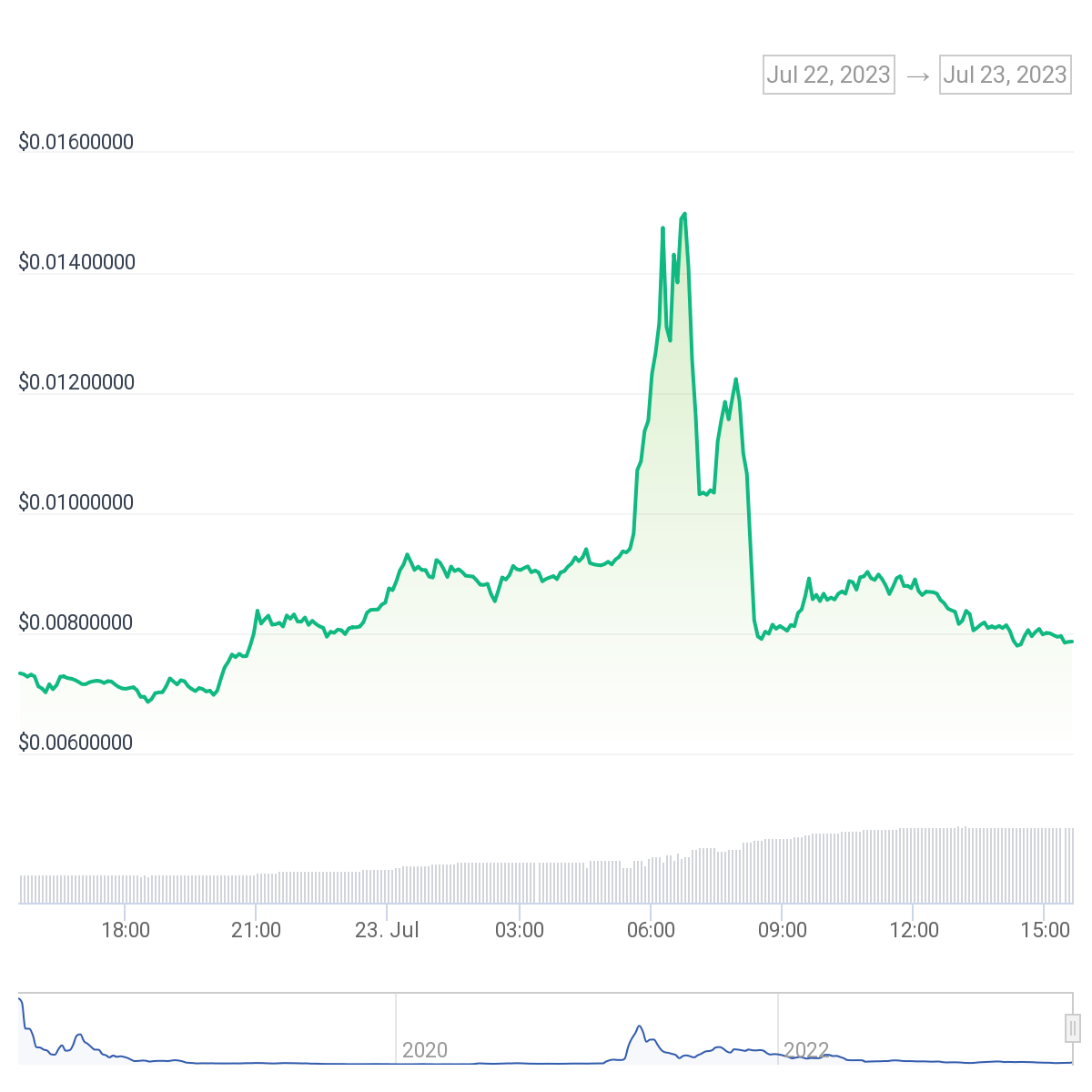

STMX token recorded unusual price movements in the last few hours, leading to speculation of market manipulation among market watchers.

The sudden rise of the token, followed by a rapid descent, has left several derivatives traders liquidated. Binance also updated its STMX futures contract.

STMX Crashes After Surge

The token, which trades on several exchanges, including Binance, recorded a massive surge in its price over the last 24 hours. It peaked at $0.015 earlier today but soon saw a rapid decline in price, dropping by about 45% to $0.0081.

Data from Coingecko shows it has risen slightly to $0.0089 and gained 104% in the last seven days.

The unusual price movements in the last few hours have raised concerns about market manipulation, although no clear evidence supports these claims. Wu Blockchain reported that the South Korean exchange UpBit accounts for 72% of the trading volume of $495 million.

STMX is the native token of StormX, a platform that allows users to earn crypto cashback by shopping on several online marketplaces listed on its app.

Liquidations for STMX Futures Traders

The price movements have also resulted in massive liquidations for those who held STMX positions. Data from Coinglass shows that STMX liquidations in the last 24 hours are $3.78 million. The liquidations affected bears and bulls, with $2.77 million in short and $1.01 million in long liquidations.

Binance customer service said that its team investigated the incident and would provide more information later.

“Regarding the emergency incident of the $stmx contract, the relevant team is dealing with it urgently. Further information will be synchronized with you later.”

The statement also directed those affected to use the online customer service to fill out the appeal form.

An announcement on the Binance page earlier today also said that Binance Futures would update the leverage and margin tiers of the USDⓈ-M STMXUSDT Perpetual Contract on 2023-07-23 at 07:15 (UTC).

It would also increase the funding rate settlement frequency for the contract from every eight hours to every 2 hours and raise the capped funding rate multiplier from 0.75 to 1.

Users were advised to adjust their position and leverage before the adjustments as it would affect existing open positions and could lead to liquidations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link