MicroStrategy’s Bitcoin Holdings Hit $600M Unrealized Losses

[ad_1]

Bitcoin’s recent price crash to around $25,000 has left MicroStrategy Inc, the largest corporate holder of the digital asset, with over $600 million in unrealized loss.

The Virginia-based software firm currently possesses over 150,000 Bitcoin, valued at approximately $3.96 billion in today’s market. These holdings were initially acquired at a combined cost of $4.5 billion, translating to an average purchase price of approximately $29,970 per Bitcoin. Consequently, the company now faces a deficit of $613 million.

MicroStrategy Back to Holding Bitcoin At Loss

Over the past three days, Bitcoin price fell by 11% to around $25,000 from over $29,000 recorded on August 16. This decline left several BTC holders with unrealized losses and meant that MicroStrategy Bitcoin holdings turned red for the first time since June.

The firm’s BTC bet turned profitable after the flagship asset surged above $30,000 due to the wave of institutional interest in the market.

However, the unrealized losses will unlikely deter the software company’s firm conviction about BTC. Michael Saylor, MicroStrategy’s chairman, is a vocal Bitcoin maxi who has regularly touted the asset as “digital gold.” Saylor is leading the firm’s Bitcoin acquisition strategy and has repeatedly said it would not sell its holdings.

Despite these unrealized losses, MicroStrategy’s MSTR is up 132% on the year-to-date metrics. However, it is down 14.49% in the last five days, according to Tradingview data.

Bitcoin Percentage in Profit Drops

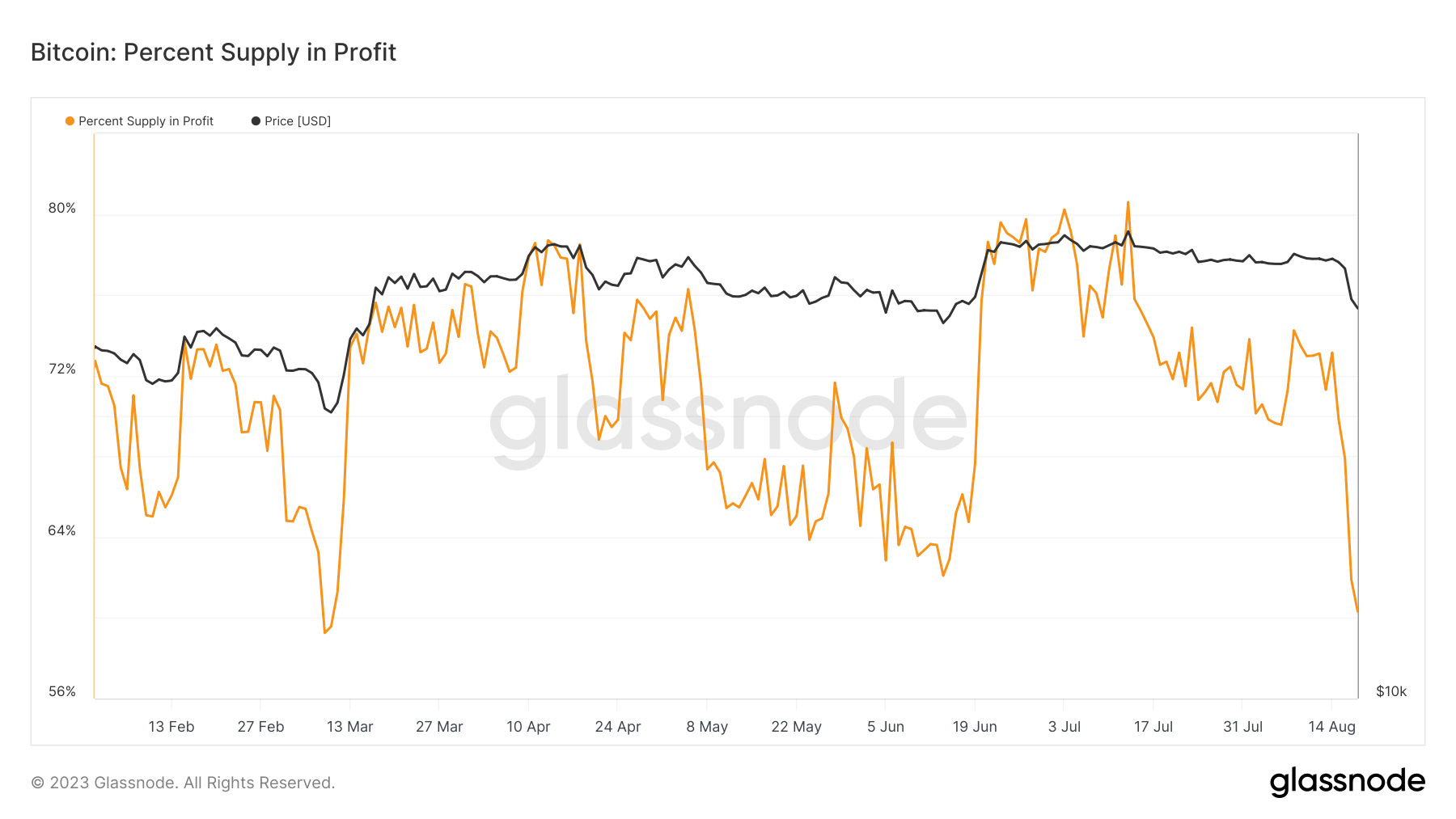

Meanwhile, the unrealized loss is not peculiar to MicroStrategy as the percentage of Bitcoin in profit fell by more than 10% in the last few days.

Glassnode’s data show that the percentage of Bitcoin supply in profits fell to 60% from 73% within the past week. This coincided with when the asset experienced a drastic plunge in its value.

Earlier in the week, the on-chain analytics firm reported that the market was slightly “top-heavy,” adding that many price-sensitive investors were at risk of falling into an unrealized loss.

It should be noted that the current market condition is yet to deter long-term holders’ (LTH) conviction about the asset. This cohort holds 75% of the cryptocurrency’s circulating supply. LTHs are classified as BTC holders who have held for a minimum of 155 days.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link