In Three Weeks, Institutions Acquire 3.3% of Bitcoin’s Total Supply

[ad_1]

The introduction of Bitcoin exchange-traded funds (ETFs) has sparked discussions about the long-term prospects of Bitcoin and its supply. Despite the lack of immediate impact on its price, approval has triggered a reversal, with institutional entities providing Bitcoin ETFs to increasingly accumulate the digital asset.

BlackRock, the world’s largest asset manager, is among the institutions involved, raising hopes that the increasing participation of retail investors in Bitcoin ETFs will contribute to future price gains.

Bitcoin ETF Applicants Bolster Supply of Bitcoin

A recent report indicates that the combined 11 spot Bitcoin ETF applicants hold approximately 3.3% of the current Bitcoins supply.

The recently approved Bitcoin ETF applicants include Grayscale, BlackRock, Fidelity, Franklin Templeton, Invesco, VanEck, WisdomTree, Hashdex, Bitwise, Valkyrie, and BZX.

According to the most recent data from Ycharts, there are currently 19.61 million Bitcoins in circulating supply.

Yet, within the crypto industry, speculation abounds regarding the potential impact of the upcoming Bitcoin halving in April on both price and supply.

Occurring every four years, this event involves the halving of mining rewards, consequently diminishing the rate at which new Bitcoins are created and reducing the overall available supply.

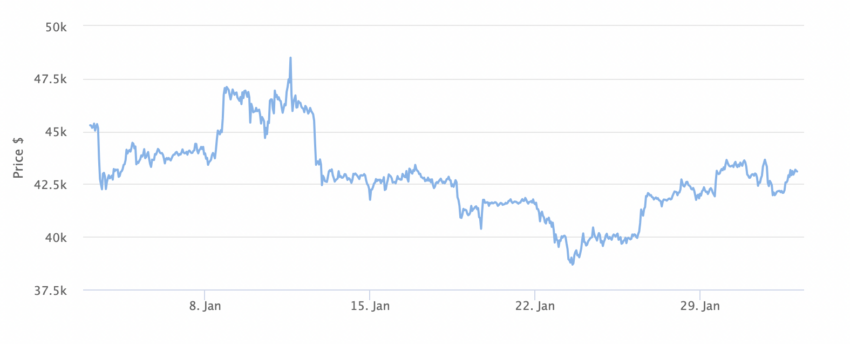

At the time of publication, Bitcoin’s price is $42,062.

Read more: What Is A Bitcoin ETF?

Bitcoin ETFs Did Not Meet Initial Expectations

On Jan 10, the SEC greenlit 11 spot Bitcoin ETF applications, sparking expectations of an imminent price surge.

Contrary to speculation, Bitcoin’s value has since declined by around 10% post-approval.

Read more: Who Owns the Most Bitcoin in 2024?

On January 16, Gary Gensler, the Chair of the SEC, expressed irony in approving spot Bitcoin ETFs. He believes that such financial products contradict the principles of Bitcoin, introducing centralization to the digital asset.

Gensler cautioned that this decision could exacerbate speculation and add to the volatility of an already unstable market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link