Crypto Market Capital Is Shuffling Around, Says Benjamin Cowen

[ad_1]

Over the last 24 hours, there has been a noticeable uptick in the cryptocurrency market, though Benjamin Cowen suggests that the influx into the crypto space may not exclusively stem from new investors.

Cowen suggests that this could be a result of market investors favoring more conservative options for their crypto portfolios, indicating a shift in preference.

Crypto Market Capital Placement Shifts

Cowen points out that the crypto market currently resides in a zone where, if the total market cap fails to achieve new heights, it might simply be a matter of investors reshuffling their portfolios’ capital:

“If TOTAL (total crypto marketcap) cannot break out here (same spot it was rejected in April and July), then I still think what we are witnessing is a rotation of capital from altcoins to BTC, rather than a lot of new money coming into the space.”

At the time of this publication, CoinMarketCap data shows that the total market capitalization of crypto is $1.23 trillion.

Learn more: 4 Best Crypto Brokers for Buying and Selling Bitcoin in 2023

However, Cowen’s comments garnered a variety of responses from X users. Some are of the opinion that it marks the inception of the alt season, while others expressed skepticism about his remarks.

“Some alts are gonna fly from here real soon,” one X user posted.

Bitcoin Positive News In Recent Times

“Hard to imagine alt coins performing well in this macro environment. I think if bitcoin pulls back many alts will get crushed,” another X user stated.

Meanwhile, another user stated that the surge is due to an increase in Bitcoin inflows, which trickled down into altcoins:

“Alts pumped as well. Not as much as BTC but still. My guess is that new capital came into BTC and that it will eventually dripple down into alts. Time will tell..It gets really interesting in the coming weeks and months.”

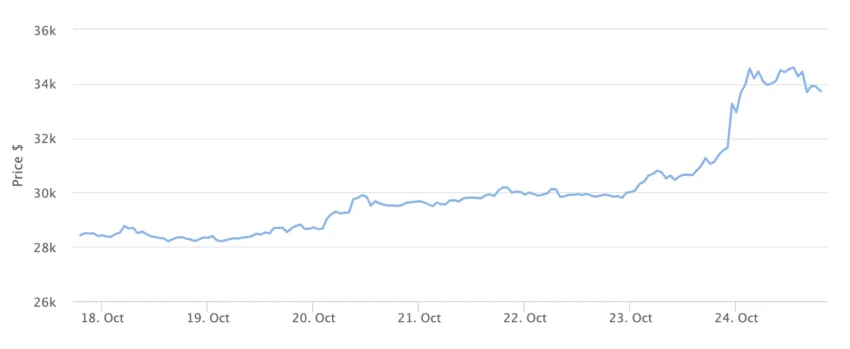

At the time of publication, Bitcoin’s price stands at $33,839.

Bitcoin has dominated discussions within the crypto community this week. This is due to two favorable advancements concerning Bitcoin ETFs.

The US Court of Appeal issued a “formal mandate” to the US Securities and Exchange Commission (SEC) to re-review Grayscale’s application for a spot Bitcoin ETF.

On September 29, BeInCrypto reported that a long-term chart has been indicating a bullish pattern developing over the last few months. It was noted that if this continues, it could lead to a recovery in the altcoin market.

Learn more: Bitcoin Halving Cycles And Investment Strategies: What To Know

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link