Could Bitcoin Be Your Financial Lifesaver?

[ad_1]

Large banks like Credit Suisse are faltering and requiring bailouts, which leads to the question: Is your money really safe in traditional banking systems during a banking crisis? With Bitcoin and other cryptocurrencies gaining popularity, it is time to consider the role of these digital assets as potential safe havens.

But what are the possibilities and risks of storing wealth in Bitcoin during banking crises?

The Shaky Ground of Traditional Banks

The global financial ecosystem is in a precarious state. The collapse of Credit Suisse, a global-systemically important bank (G-SIB), has set off alarm bells worldwide.

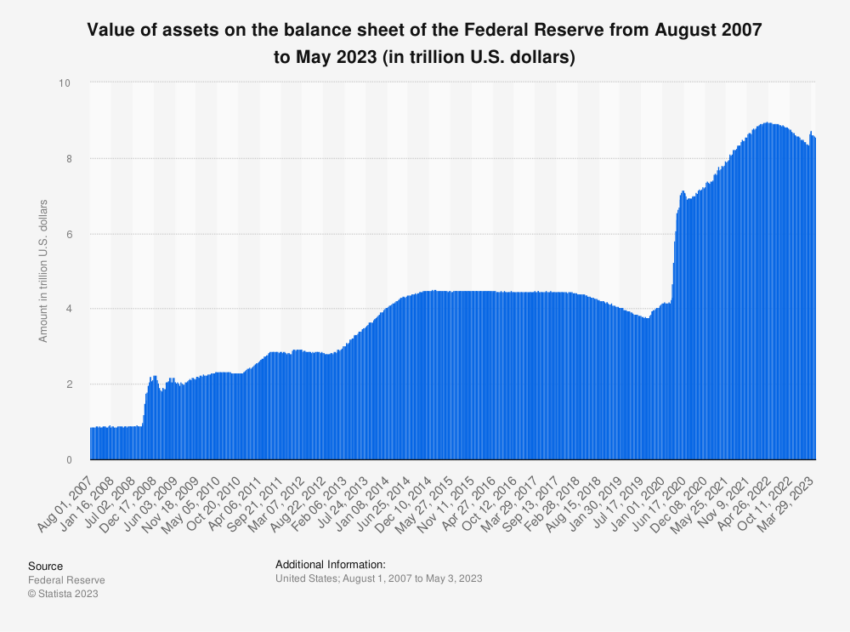

This failure, coupled with the fact that no banks fell during the last decade of quantitative easing (QE), prompts one to question the stability of our banking systems.

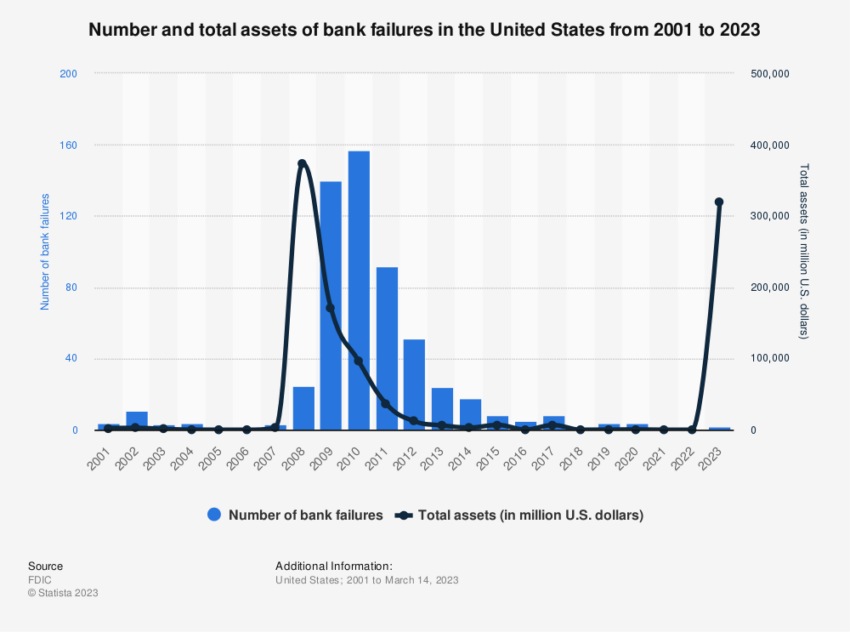

Historically, bank failures were a natural part of free markets, helping to purge excess risk. However, with governments and central banks expanding the money supply unprecedentedly, bank failures have become a rarity.

Is this a result of safer banking practices or merely a byproduct of money printing and government bailouts that have shifted the risk off bank balance sheets?

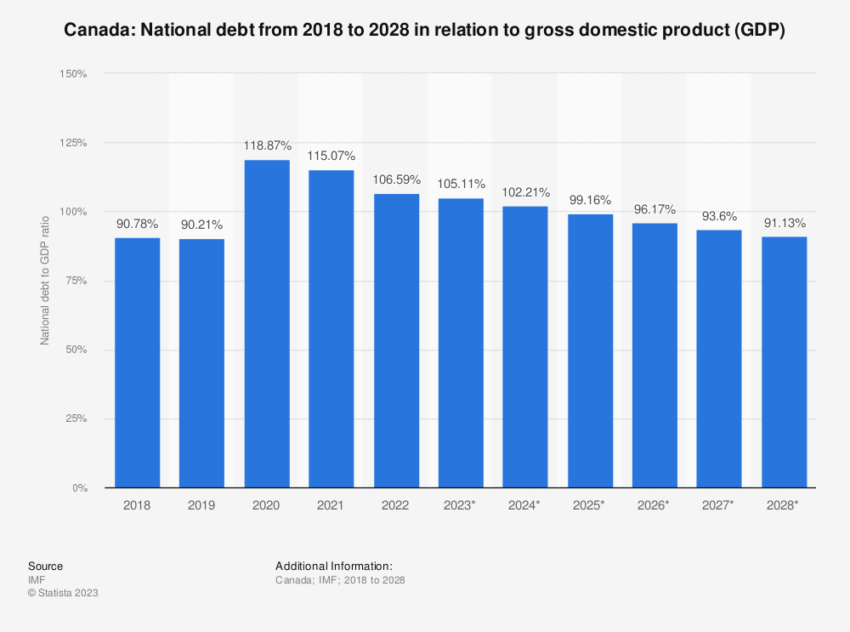

Countries like Canada have followed the G20 consensus, engaging in QE and issuing debt to finance deficit spending. Such practice has led to a surge in public and private debt-to-GDP ratios.

This trend can potentially inflate asset bubbles and contribute to economic instability.

Economist Joseph Barbuto has highlighted the high Canadian debt-to-GDP ratio. He has drawn comparisons to the US debt-to-GDP ratio during World War II.

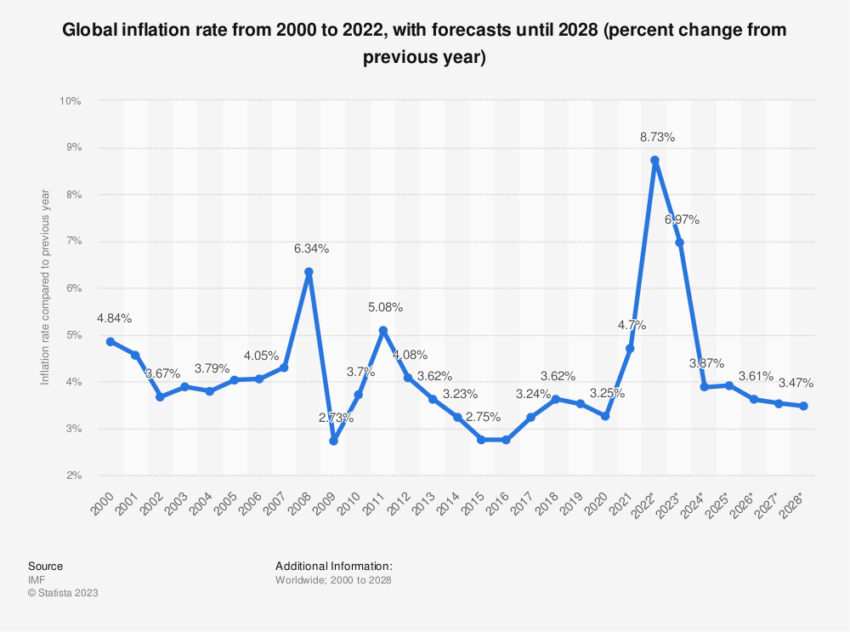

This alarming rise in debt levels has sparked a debate about the effectiveness of QE. Many economists are accusing central banks of artificially manipulating rates and contributing to inflation.

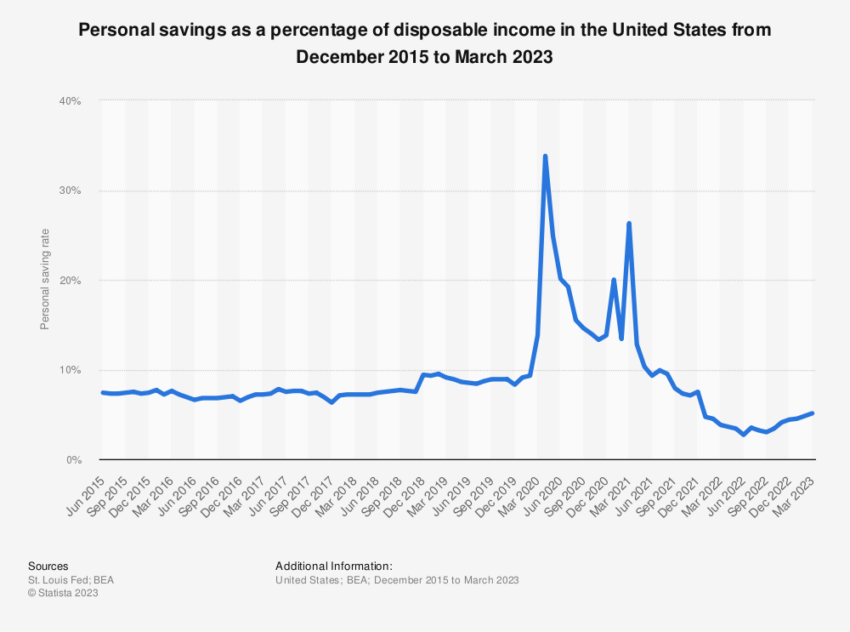

The Great Withdrawal – A Sign of Lost Confidence

As trust in banks dwindles, people are increasingly withdrawing their funds. High-interest rates are another contributing factor, encouraging depositors to seek higher yields in alternative investment vehicles.

This trend has led to the rise of digital bank runs, with record-breaking withdrawals from traditional banks. For this reason, the banking industry’s practices are under scrutiny.

For example, banks receive about 5% interest on the money they park at the central bank after buying government debt during QE. Meanwhile, depositors are given a savings rate of roughly 0%.

This unfair discrepancy leads people to transfer their savings to other assets, including Bitcoin.

The banking crisis has resulted in three of the largest bank failures in US history, with Silicon Valley Bank, Signature Bank, and First Republic Bank falling victim.

These failures have led to a series of emergency actions by the Federal Reserve, including bailouts and lending programs designed to prevent the realization of losses on US treasuries.

However, the intervention of central planners in the free market pricing mechanism has raised concerns. The Federal Reserve is now acting as a “loan shark” for small and medium-sized banks, potentially exacerbating the crisis.

Bitcoin – A Safe Haven Amid Banking Crisis?

While traditional banking systems are under strain, Bitcoin emerges as a potential safe haven.

Despite its volatility, Bitcoin provides a decentralized and secure alternative to traditional banking. The digital asset is immune to inflation and government interference, making it an attractive option during banking crises.

However, the transition to digital assets is not without risks. Like any investment, Bitcoin’s value can fluctuate, and it is crucial to understand these risks before transferring wealth into digital assets. Nevertheless, Bitcoin may offer a degree of protection in times of banking uncertainty.

Its decentralized nature allows it to operate independently of central banks and government control. This could offer a financial refuge for those looking to escape a potential banking crisis.

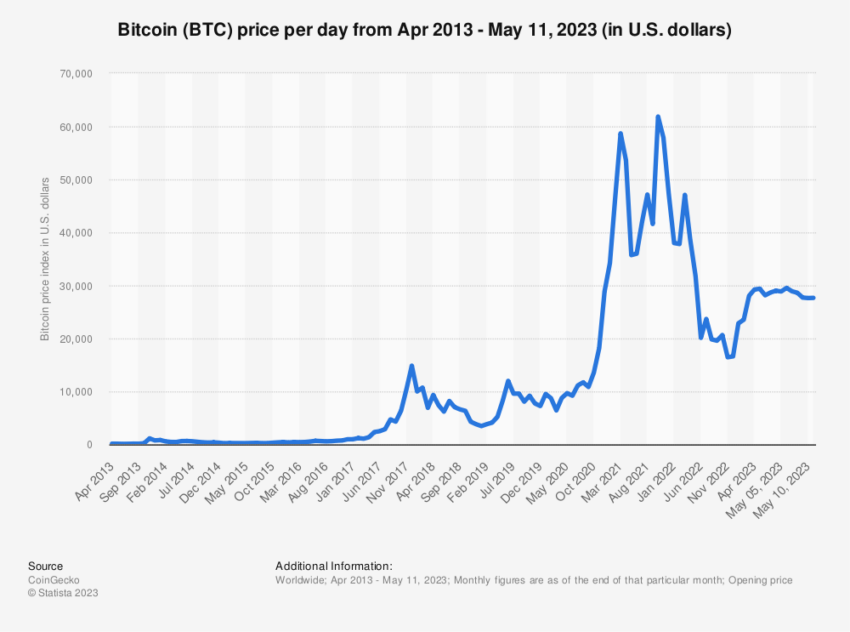

Although Bitcoin’s price is volatile, its value is not directly correlated to any specific economy, which can be advantageous when traditional financial institutions are unstable. Additionally, while governments can print more money and cause inflation, Bitcoin’s supply is finite, providing a degree of protection against currency devaluation.

Bitcoin’s potential as a safe haven during banking crises is not purely theoretical; real-world events provide valuable insights.

For example, during the economic crisis in Venezuela, Bitcoin usage soared as citizens sought to protect their wealth against hyperinflation. Similarly, Bitcoin’s price significantly surged after the 2013 banking crisis in Cyprus as investors looked for safe havens.

While these instances do not prove Bitcoin’s absolute security, they highlight its potential role as an alternative financial refuge during banking crises. However, it is crucial to remember that Bitcoin carries its own risks, such as price volatility and regulatory uncertainty.

Is Your Money Safe in Bitcoin?

Investing in Bitcoin as a hedge against banking crises is not a one-size-fits-all strategy. It depends on individual circumstances, risk tolerance, and understanding of cryptocurrencies.

While Bitcoin can offer potential advantages such as inflation protection and independence from traditional banking systems, it also carries significant risks.

Therefore, for those considering Bitcoin as an alternative to traditional banking, it is essential to understand the dynamics of the crypto market, the technology underlying Bitcoin, and the potential legal and financial implications.

The safety of money in Bitcoin during a banking crisis largely depends on how one defines “safe.” If safety means preserving the purchasing power of one’s wealth amidst rampant inflation and banking instability, Bitcoin could potentially serve as a viable refuge.

However, if safety means maintaining a stable investment value, Bitcoin’s volatility could pose a significant risk.

While Bitcoin may offer a financial sanctuary during banking crises, it is not a guaranteed solution. It is a relatively new and rapidly evolving asset class that should be approached thoroughly and carefully, considering its associated risks.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link