Stablecoin Accumulation Steadily Increasing Since Mid-April

[ad_1]

On-chain data suggests that whale accounts have been stashing stablecoins recently. The move could be in preparation to start buying crypto again.

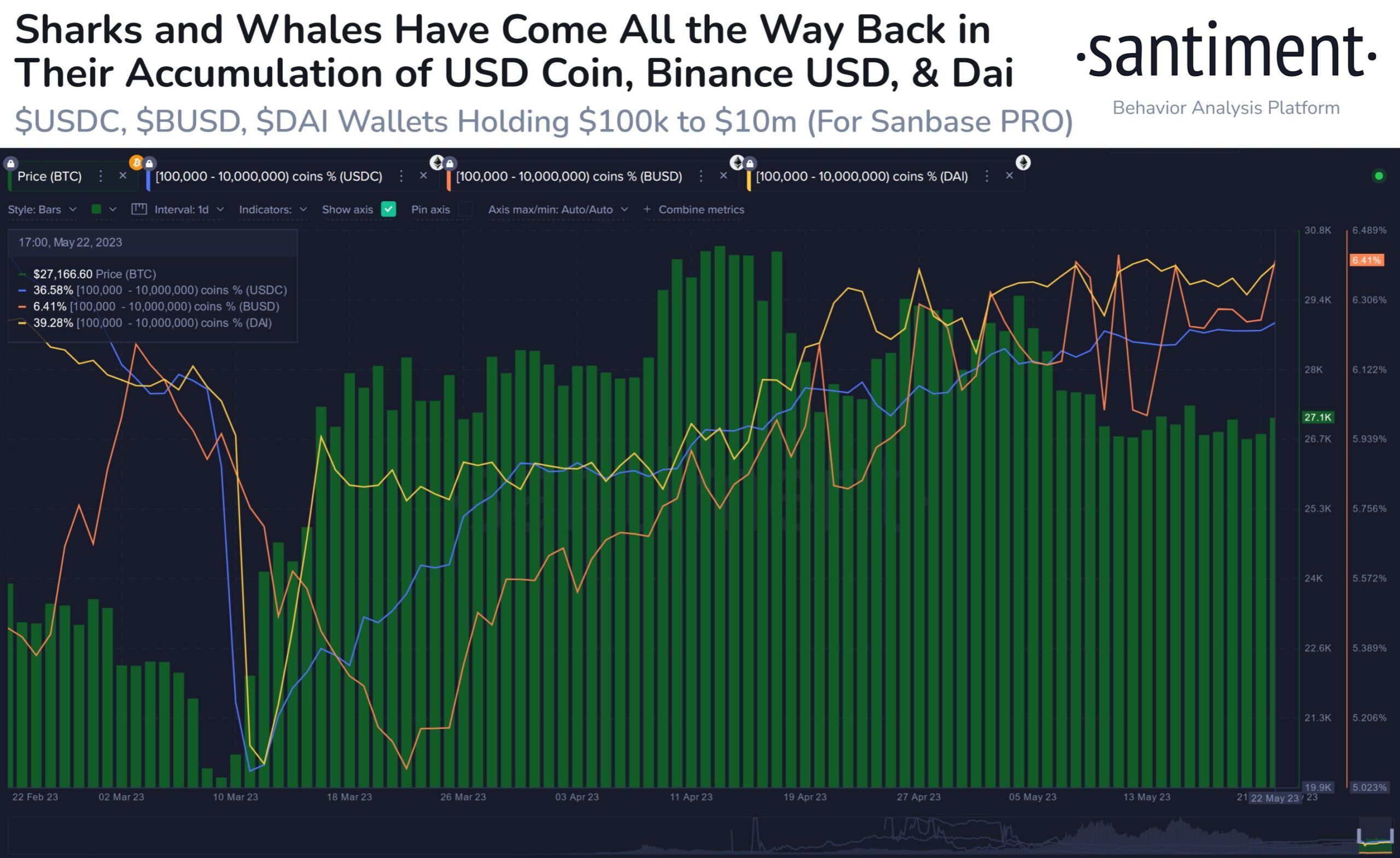

On May 24, on-chain analytics provider Santiment reported that big bag holders are not buying much Bitcoin at the moment. Instead, they have been loading up on stablecoins, favoring USDC and DAI.

“As sharks and whales stay flat on their Bitcoin holdings, we are seeing that stablecoins have been accumulated by these large holders, increasing their future implied buying power.”

According to the data, 37% of wallets holding between $100,000 and $10 million hold USDC. Furthermore, 39% of wallets in the same cohort are holding MakerDAO’s DAI stablecoin. Just 6.4% of whale wallets were holding Binance USD (BUSD). There was no data on Tether holdings.

Whales Holding For Another Dip?

There has been an uptick in whale stablecoin positions since mid-April. This coincided with Bitcoin’s 2023 peak price of $31,000. Since then, the asset has retreated 13.7% to current prices as profit has been taken.

Whale movement into stablecoins may be seen as waiting to buy the dip. However, it could also be used to fund short positions on Bitcoin.

Similarly, exchange inflows have also fallen to cycle lows, which could signify increased hodling. As reported by BeInCrypto, the reduced exchange liquidity could spell increased volatility in crypto markets.

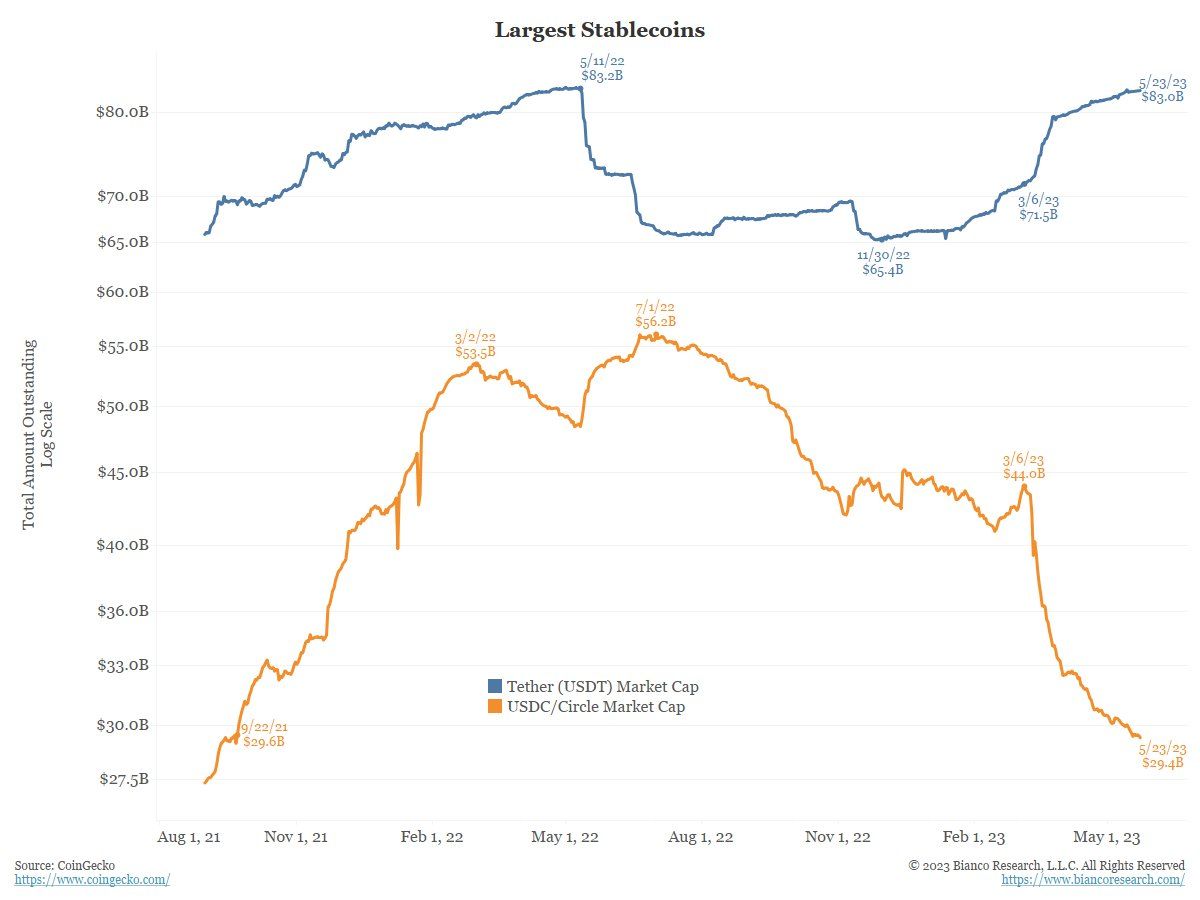

Regardless of what whales are doing with their stablecoins, there has been a large divergence in the stablecoin ecosystem.

Tether USDT and Circle USDC market capitalizations are also moving apart. Tether’s market cap is increasing while Circle’s is shrinking. On May 23, researcher Jim Bianco observed this, commenting that “they are moving opposite the conventional wisdom.”

The sentiment was very anti-Tether in 2022 following the Terra/Luna and FTX collapses. However, it turned against Circle in 2023 after it de-pegged following exposure to Silicon Valley Bank. Bianco noted:

“The combination of the SVB episode, the aggressive regulatory moves to crush crypto, and the looming debt ceiling/default have completely turned the tables against USDC and in favor of Tether.”

Stablecoin Ecosystem Outlook

Tether currently commands a dominant market share of 63.6% with a circulation of $83 billion. Furthermore, the USDT supply has grown by 25.4% since the beginning of 2023.

Conversely, Circle’s supply has shrunk by 34% in the same period. This has dropped its market share to just 22.5%, with $29.3 billion USDC in circulation.

U.S. regulators targeted Paxos and BUSD in February. Minting was halted, and supply has slumped 67.5% since the beginning of the year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link