7 Million Ethereum (ETH) Locked on Liquid Staking Protocols

[ad_1]

The number of Ethereum tokens locked in liquid staking derivatives protocols has surpassed seven million, according to data from Defillama.

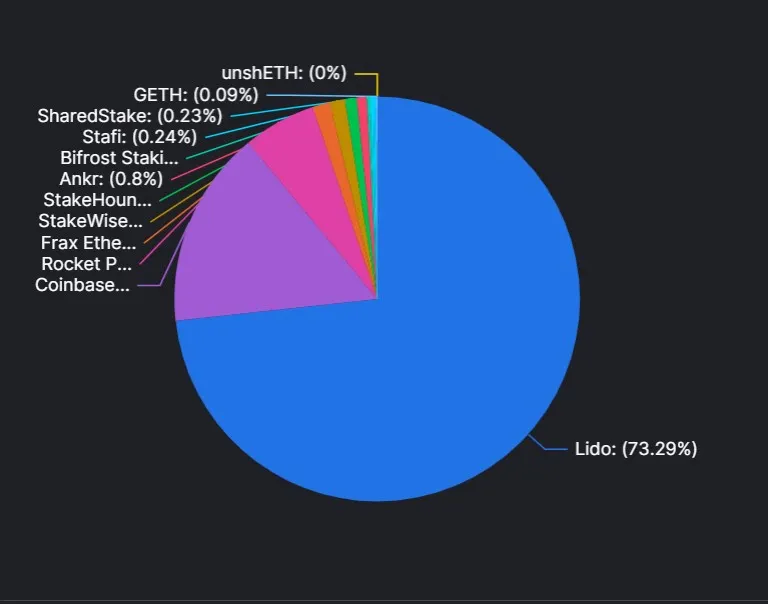

Currently, the total value of assets locked on these platforms stands at nearly $12 billion. The market is dominated by the top three liquid staking platforms, which control 95% of the market.

Huge Spike in Locked Ethereum

Lido is the biggest player, responsible for over 70% of the locked ETH, holding over 5 million ETH valued at $8.7 billion. Coinbase comes in second with 1.1 million staked ETH, while DeFi protocols RocketPool and Frax Ether cumulatively have around 500,000 ETH staked on their platforms.

The amount of locked ETH on platforms has risen since Ethereum developers announced that they would prioritize staked ETH withdrawals in the Shanghai upgrade. Additionally, the US Securities and Exchange Commission’s charges against Kraken crypto exchange have made liquid staking protocols more attractive to investors.

Most ETH Stakers are Underwater

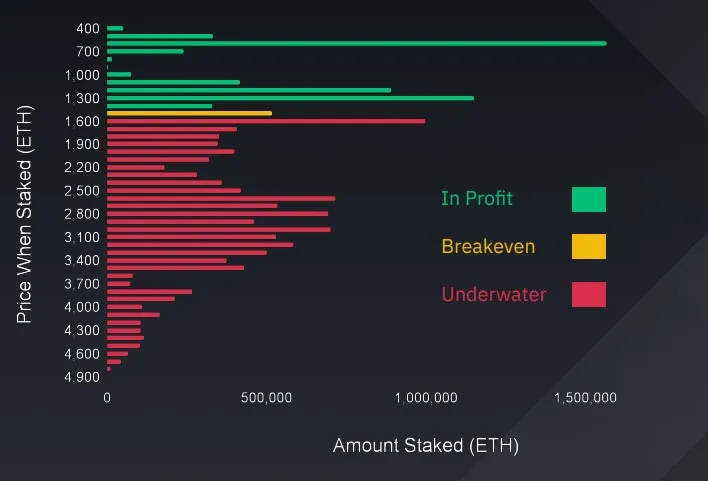

However, the increased ETH staking activity over the past few months has not translated into profits for investors. Although more than 16 million ETH units have been staked, most stakers are currently at a loss.

According to Binance Research, around 69% of ETH stakers are underwater due to having staked their assets when ETH was trading above $1,600. Binance added that about 2 million ETH were staked when the digital asset was trading between the $400 to $700 range in December 2020.

These stakers are likely illiquid since liquid staking was not as well-known at the time. Binance notes that this cohort are “some of the strongest Ethereum believers,” meaning they likely wouldn’t sell even when withdrawals become available.

Despite these challenges, Ethereum’s price has increased by 42% on a year-to-date basis. The second-largest cryptocurrency by market cap has risen 11.8% in the past seven days and gained 2% in the last 24 hours to trade at $1,693 as of press time.

Since completing its transition to a proof-of-stake network, Ethereum’s supply has become deflationary, with its supply having reduced by over 28,000 ETH, according to data from ultrasound.money.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

[ad_2]

Source link