While Miners Deal With Low BTC Prices, Bitcoin’s Mining Difficulty Target Expected to Increase 3% Higher – Mining Bitcoin News

[ad_1]

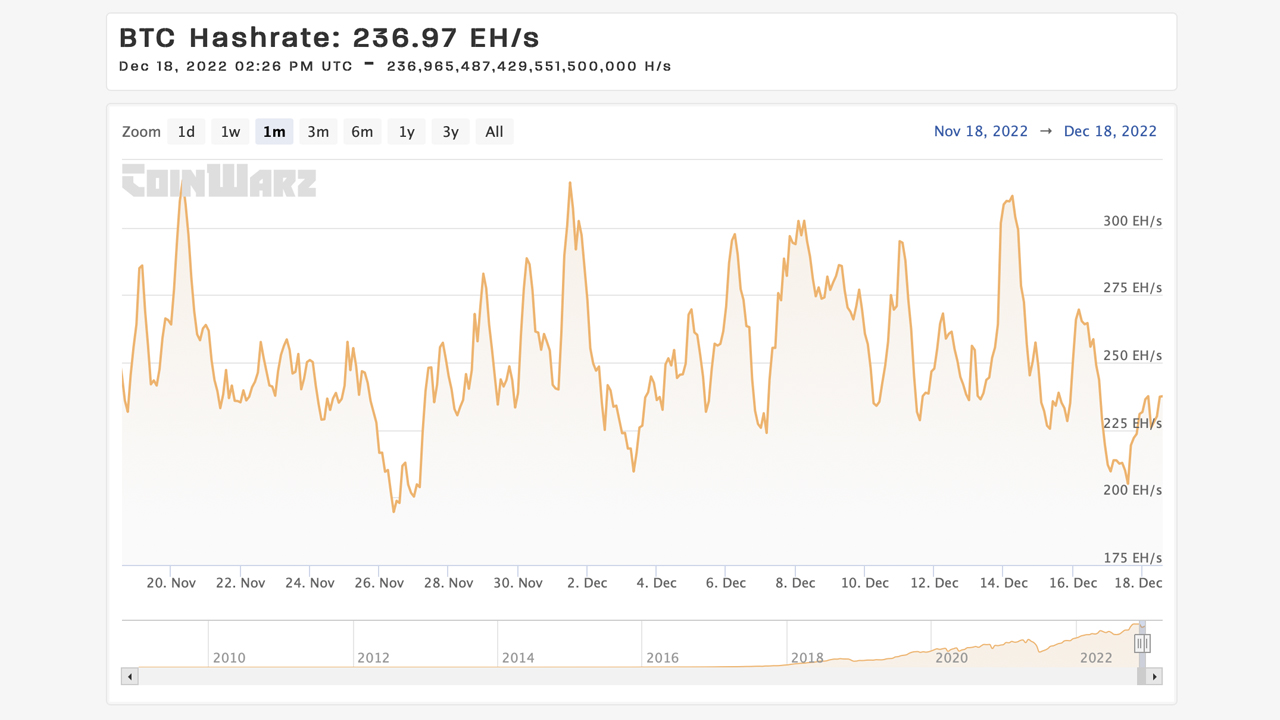

Bitcoin’s mining difficulty target is expected to increase on Dec. 19, 2022, after printing the largest reduction recorded in 2022 on Dec. 5, at block height 766,080. During the last 2,016 blocks, Bitcoin’s hashrate has been around 254.3 exahash per second (EH/s), and block intervals have been faster at 9:41 minutes per block.

Bitcoin’s Difficulty Expected to Jump 3% Higher on Dec. 19, Bitcoin Average Mining Costs Are Higher Than the Current Spot Market Value

In roughly 24 hours, the Bitcoin network will experience another difficulty transition, and this time around it is estimated to increase. The increase is estimated to be around 3.2% to 3.76% higher than the current 34.24 trillion value. The rise would lift the 34.24 trillion to around 35.53 trillion on or around Dec. 19, 2022.

Data shows that while the network’s difficulty is increasing, BTC’s hashrate has been lower than the month prior. Bitcoin’s hashrate did tap a high of 316 EH/s on Dec. 1, 2022. The average block time or block interval is between 9:41 minutes per block to roughly 10:43 minutes per block.

The estimated 3% change is occurring after the last difficulty change which saw a reduction of around 7.32% on Dec. 5, at block height 766,080. The network’s mining difficulty retarget on that day was the largest recorded decrease in 2022. If the estimated increase occurs on Dec. 19, 2022, roughly 3% of the most recent reduction will be erased making it more difficult for miners to find a BTC block.

During the past three days, Foundry USA has been the Bitcoin network’s top mining pool with 27.05% of the overall hashrate or 66.59 EH/s. Foundry is followed by Antpool (53.51 EH/s), F2pool (35.08 EH/s), Binance Pool (31.51 EH/s), and Viabtc (22 EH/s) respectively. 414 block rewards were discovered during the last three days and the top five aforementioned mining pools discovered 351 of those blocks.

On Dec. 17, macromicro.me stats show bitcoin average mining costs based on metrics from Cambridge University, indicating that the cost is around $19,806, and BTC’s price on Dec. 18, is around $16,700 per bitcoin.

What do you think about Bitcoin’s upcoming difficulty retarget on Dec. 19? What do you think about the pressure bitcoin miners are feeling these days from low bitcoin prices? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link