Terra Supporters Hope to ‘Defy the Odds’ by Pumping the Now-Defunct Stablecoin USTC Back to $1 Parity – Altcoins Bitcoin News

[ad_1]

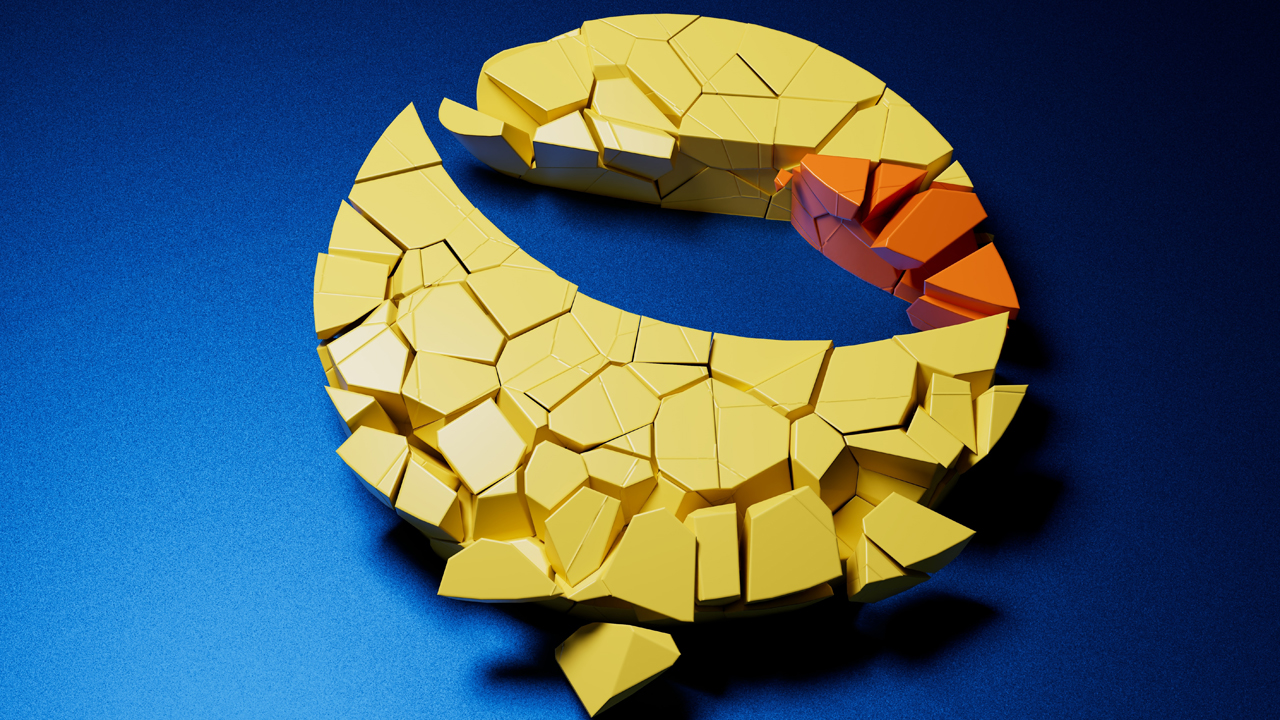

It’s been six months since Terra’s algorithmic stablecoin UST (now USTC) depegged from the U.S. dollar and the price has remained depegged from the greenback since May 9, 2022. Currently, the former stablecoin is exchanging hands for $0.02 per unit, but a number of Terra Classic supporters believe there’s a chance USTC can regain its peg.

Terra Supporters Want to Repeg the Once-Stable Coin USTC

Amid the craziness surrounding the FTX collapse, fans of another stunted crypto project want to get Terra Money’s former stablecoin UST (now USTC) back to the $1 price range. There’s been a lot of discussion about the subject on social media, even though the token terraclassicusd (USTC) is nowhere near the greenback’s face value. That hasn’t stopped Terra Classic supporters from trying to rally support for the now-defunct Terra token. “Let’s repeg USTC,” one individual tweeted, while others have shared pictures of USTC rising to $1 complete with rocketship emojis.

In addition to a number of Terra Classic blockchain fans, the R&D developer at Terran One and former developer at Terra Money, Will Chen, talked about the possibility of USTC repegging. “The USTC repeg is the first time something like this at this scale has ever been attempted by a community,” Chen said. “Like LUNC, once the communal effort to repeg USTC makes progress/momentum that defy the odds and surprises all the non-believers, everybody will want to join in.”

Chen’s tweet has more than 1,154 likes on Twitter and it’s been shared around 400 times since the tweet was published. The Terran One dev also wished the community the “best of luck.” Of course, getting USTC back to the $1 range would be a miracle and it is an accomplishment that has never been achieved thus far in the history of crypto. Chen’s optimistic tweet, however, was challenged, as many people believe the feat is impossible. One person wrote:

It requires [$9.5 billion] that nobody has, or burning [more than] 90% of USTC ( = defaulting on it). Which is fine … but it will require a lot more than slogans.

Terra Classic blockchain fans disagreed with this assessment and said that it was possible the debt could be cleared. “No, it doesn’t require [$9.5 billion],” an individual replied. “Market did price the debt, less than 200 million USD. [Luna Foundation Guard] assets are still backing the debt, via buy-back-burn on USTC. Little inflation on [LUNC] and tax % could go to clear the debt. [Binance’s CEO CZ] could burn the debt with the spot trading fees,” the person added.

At the time of writing, USTC is currently trading for $0.020 per unit and the crypto asset is down 3.5% during the last day against the U.S. dollar. Last month USTC’s value was a lot higher as the coin shed 50.9% in value over the past 30 days. Terra Classic’s LUNC is even lower and less than a U.S. penny per unit at $0.00015820 per LUNC.

In order to get USTC back to the $1 range it would have to climb 4,900% higher than its current value. Currently, there is 9,805,804,874 USTC in circulation and the token has recorded $15.33 million in trades during the last day. While getting USTC back to $1 would be quite the feat, the token is struggling to remain above two U.S. pennies.

What do you think about the Terra supporters hoping to repeg USTC back to the $1 parity it once held? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link