Why a Bitcoin ETF Could Kill Bitcoin

[ad_1]

The crypto industry is anticipating the approval of a spot Bitcoin ETF (exchange-traded fund) in the United States. However, a major industry leader believes that the success of such financial products might lead to the end of BTC.

BitMEX founder Arthur Hayes warned that the launch of spot Bitcoin ETFs may challenge the existence of the pioneer cryptocurrency.

How a Bitcoin ETF Can Kill BTC

According to Hayes, if Bitcoin ETFs, which will be managed by traditional asset managers, are too successful, they will “completely destroy Bitcoin.”

Justifying the assertion, he argued that TradFi firms will continue to acquire more BTC. As a result, Bitcoin transactions may decline as people tend to choose ETFs over holding Bitcoin directly.

“Imagine a future where the largest Western and Chinese asset managers hold all the Bitcoin in circulation. This happens organically as people confuse a financial asset with a store of value. Because of their confusion and laziness, people purchase Bitcoin ETF derivatives rather than buying and hodling Bitcoin in self-custodied wallets. Now that a handful of firms hold all the Bitcoin, and have no actual use for the Bitcoin blockchain,” Hayes said.

The final outcome is that miners are compelled to shut down their equipment, unable to sustain the energy costs necessary for operation. Such a scenario could lead to Bitcoin’s tragic demise.

Moreover, Hayes argued that aside from killing Bitcoin, the crypto industry may lose its fight to separate money from the state if these ETFs become too successful.

BlackRock Amends ETF Filing

Despite Hayes’ warning, nothing appears to be stopping traditional firms from their ambition to get a spot Bitcoin ETF approved. Several Bitcoin ETF applicants, including BlackRock, Hashdex, and Pando, submitted revised filings to the financial regulator.

Bloomberg Analyst James Seyffart pointed out that asset manager BlackRock’s revised filing comes with a $10 million seed funding proposal. While not guaranteeing an immediate launch, this proposed funding indicates the Bitcoin ETF’s potential preparedness for a forthcoming launch.

“BlackRock expecting to seed IBIT with $10 million on Jan 3rd… Notable the date and that it is a pretty big bump up from the $100,000 they seeded in October,” Bloomberg senior ETF analyst Erich Balchunas said.

Seyffart noted that BlackRock’s timeline aligns with earlier predictions of a January launch, indicating the firm’s intention to move forward promptly pending approval. This move follows BlackRock’s previous amendment of December 19, which incorporated the SEC-recommended in-cash redemptions into its Bitcoin ETF application.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

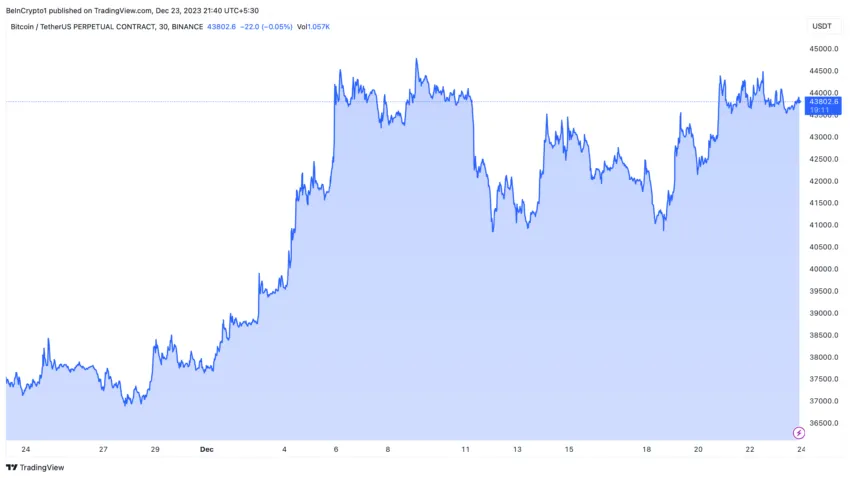

Amid these developments, Bitcoin’s price has demonstrated resilience. The top cryptocurrency briefly touched $44,000 before correcting to $43,642 at the time of writing.

Crypto trader Marco Johanning noted that Bitcoin remains below the current key resistance level of $44,400. However, he stated that he does not see any new lows for the asset.

“I see three main scenarios: 1. Break this resistance and go higher, perhaps with a small fakeout down before, for example on Sunday (weekly close). 2. Retest the red trendline with the potential for a wick to the order block, then back up and higher. 3. Ranging over Christmas and into yearly close,” Johanning said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link