CME Surpasses Binance in Bitcoin Futures Market Share

[ad_1]

It finally happened—the Chicago Mercantile Exchange (CME) has usurped Binance to become the largest Bitcoin futures exchange.

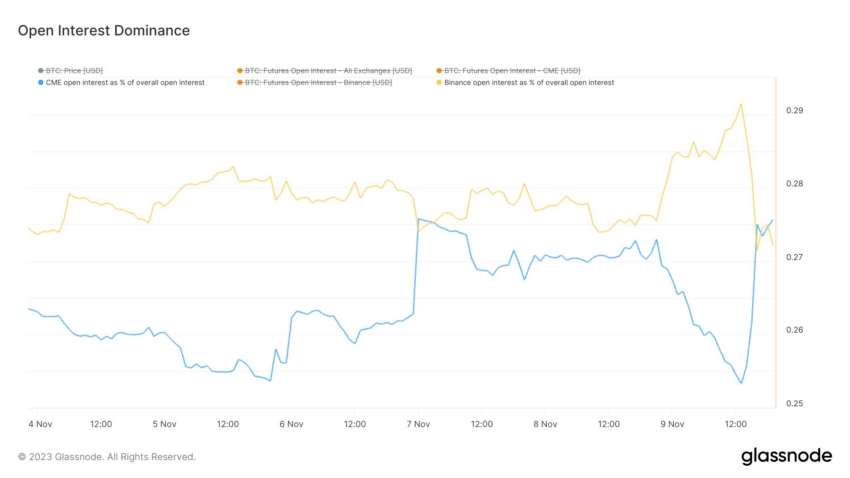

This shift in dominance, as reflected by open interest (OI), signals a potential pivot towards institutional interest in the crypto sector.

The New Bitcoin Futures King

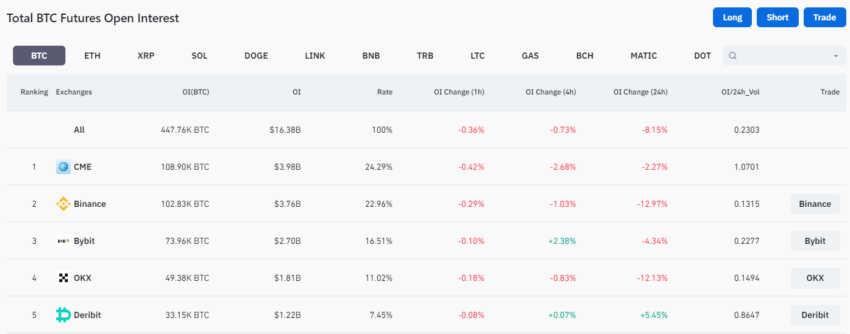

CME, renowned for its traditional futures contracts with pre-determined expiry, now boasts an open interest of approximately $4 billion. This equals out to a market share of over 24%.

In contrast, Binance, which offers both conventional futures and those without expiry, saw its OI drop to $3.76 billion, an almost 13% drop in the last 24 hours.

Last week, Gabor Gurbac, a strategy advisor at VanEck, highlighted the rising open interest in Bitcoin futures on CME. He stated,

“CME is about to flip Binance as the largest exchange with respect to Bitcoin futures open interest.”

Read more: 9 Best Crypto Futures Trading Platforms in 2023

Gurbac views this as an indication of the crypto market’s nascent phase, suggesting that physical markets will soon catch up. Crypto analyst Will Clemente also commented on this apparent retail-institutional flip:

“Bittersweet — there will soon be more suits than hoodies here.”

Forces at Play

However, this shift is not without its complexities. An X user responded to Gurbac’s observation, stating,

“I think CME’s rise underscores institutional gravitation to Bitcoin futures. Yet, it’s crucial to observe the holistic health of secondary markets and potential impacts on price discovery mechanisms.”

The scenario unfolded as Bitcoin surged to an 18-month high of nearly $38,000 before retracing to $36,000. At the same time, Ethereum moved above $2,100 for the first time in seven months. This was mainly attributed to news that BlackRock had registered an Ethereum trust in Delaware.

The rise of CME reflects a broader trend of institutional interest in Bitcoin futures. As the crypto market continues to mature, the dynamics of futures exchanges may further evolve, potentially signaling a new era of institutional investment in cryptocurrency.

Read more: How To Trade Bitcoin Futures and Options Like a Pro

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

[ad_2]

Source link