Coinbase Holds $25 Billion Worth of Bitcoin in its Reserves

[ad_1]

Blockchain analytical firm Arkham Intelligence revealed that Coinbase holds nearly 1 million units of Bitcoin. This means the exchange holds around 5% of all BTC, almost as much as Satoshi Nakamoto, the network founder.

In a September 22 post on X (formerly Twitter), Arkham Intelligence labeled Coinbase as the “largest Bitcoin entity in the world.”

Coinbase Holds $25 Billion in Bitcoin

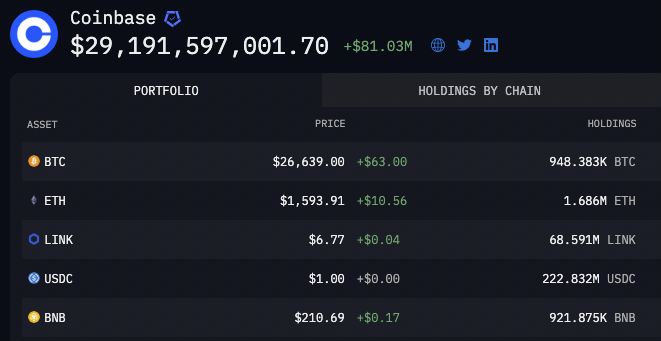

Coinbase reportedly holds 948,380 BTC, estimated at $25 billion. These Bitcoin holdings primarily represent reserves safeguarded on behalf of their customers.

Arkham Intelligence identified more than 36 million deposit and holding addresses associated with Coinbase. The most substantial among these holdings, stored in a cold wallet, contains approximately 10,000 BTC.

Meanwhile, the substantial BTC holdings are not surprising, considering CEO Brian Armstrong recently described it as the most influential crypto asset in the market. The firm also revealed its intention to integrate support for Bitcoin Lightning as further evidence of its commitment to the industry.

It is worth noting that Coinbase likely maintains additional wallets yet to be uncovered, indicating the possibility of even more undisclosed BTC holdings.

Considering that a significant portion of Coinbase’s customer base resides in the United States, these extensive Bitcoin reserves underscore the country’s notable cryptocurrency adoption. Moreover, some of these assets may be allocated to institutional use, as Coinbase offers services like Coinbase Custody tailored to institutional investors like Grayscale.

ETH, LINK, and SOL Amongst Other Holdings

Coinbase holds substantial altcoins, including Ethereum, Chainlink, USDC stablecoin, Solana, and the Binance-backed BNB Coin. Cumulatively, all the assets in its holdings, including Bitcoin, are worth more than $29 billion.

However, some of its altcoin holdings have attracted regulatory scrutiny from the Securities and Exchange Commission (SEC). The financial regulator had labeled Solana and several others as unregistered securities in its lawsuit against Coinbase. Besides that, the Commission alleged that the crypto exchange had violated federal securities law with its operation.

Meanwhile, Coinbase’s challenges with the SEC extend beyond tokens. The exchange has been at the forefront of advocating for regulatory clarity in the United States. The platform and its leadership have consistently spearheaded initiatives highlighting the regulatory uncertainties that crypto businesses navigate within the region.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link