Is Bitcoin (BTC) Price Correction Next? Key Indicators Revealed

[ad_1]

The price of Bitcoin (BTC) has been following a corrective pattern starting from July 13, which appears to be a reaction to its recent upward movement.

Despite briefly reaching a new high for the year on July 13, the subsequent price behavior suggests a potential decline. This observation is consistent with the wave count and RSI readings as well.

Bitcoin Price Drops but Holds Above Support

The daily time frame technical analysis shows that the BTC price reached a new yearly high of $31,800 on July 13 but fell immediately afterward. The next day, it created a bearish engulfing candlestick (red icon).

This is a type of bearish candlestick in which the entire previous day’s increase is negated with a large bearish candlestick.

Despite the bearish candlestick, BTC still trades inside the $30,300 horizontal area. Whether it breaks down or bounces could determine the future trend.

The daily RSI gives a decisively bearish mixed reading. The RSI is a momentum indicator used by traders to assess market conditions and determine whether to buy or sell an asset, also indicating bullish sentiment.

A reading above 50, along with an upward trend, suggests that buyers still have an advantage, while a reading below 50 suggests the opposite. While the RSI is falling, it is still above 50. Thus, the indicator provides conflicting readings.

However, what makes the RSI bearish is the triple bearish divergence in development since June 23 (green line). A bearish divergence occurs when a price increase accompanies a momentum decrease.

It means that strength in the upward movement is waning and is often followed by a bearish trend reversal.

Selling Pressure Decreasing as Retail Demand Weakens

Looking at on-chain metrics, it appears that Bitcoin selling pressure is beginning to decrease. On-chain analytics firm CryptoQuant indicates that as the short-term SOPR (Spent Output Profit Ratio) and aSOPR (Adjusted SOPR) approach the support level of 1, active participants are reaching their cost basis.

This typically results in reduced selling pressure as investors are less likely to sell their assets at a loss.

Additionally, a cause for concern is the rise in stablecoin withdrawals without significant deposit increases. This indicates a weakening of retail demand, which is particularly concerning during peak bull markets compared to the early stages.

This suggests a potential decrease in market participation and investor sentiment, as shown by the CryptoQuant Chart above.

BTC Price Prediction: Wave Count Can Help Determine Next Move

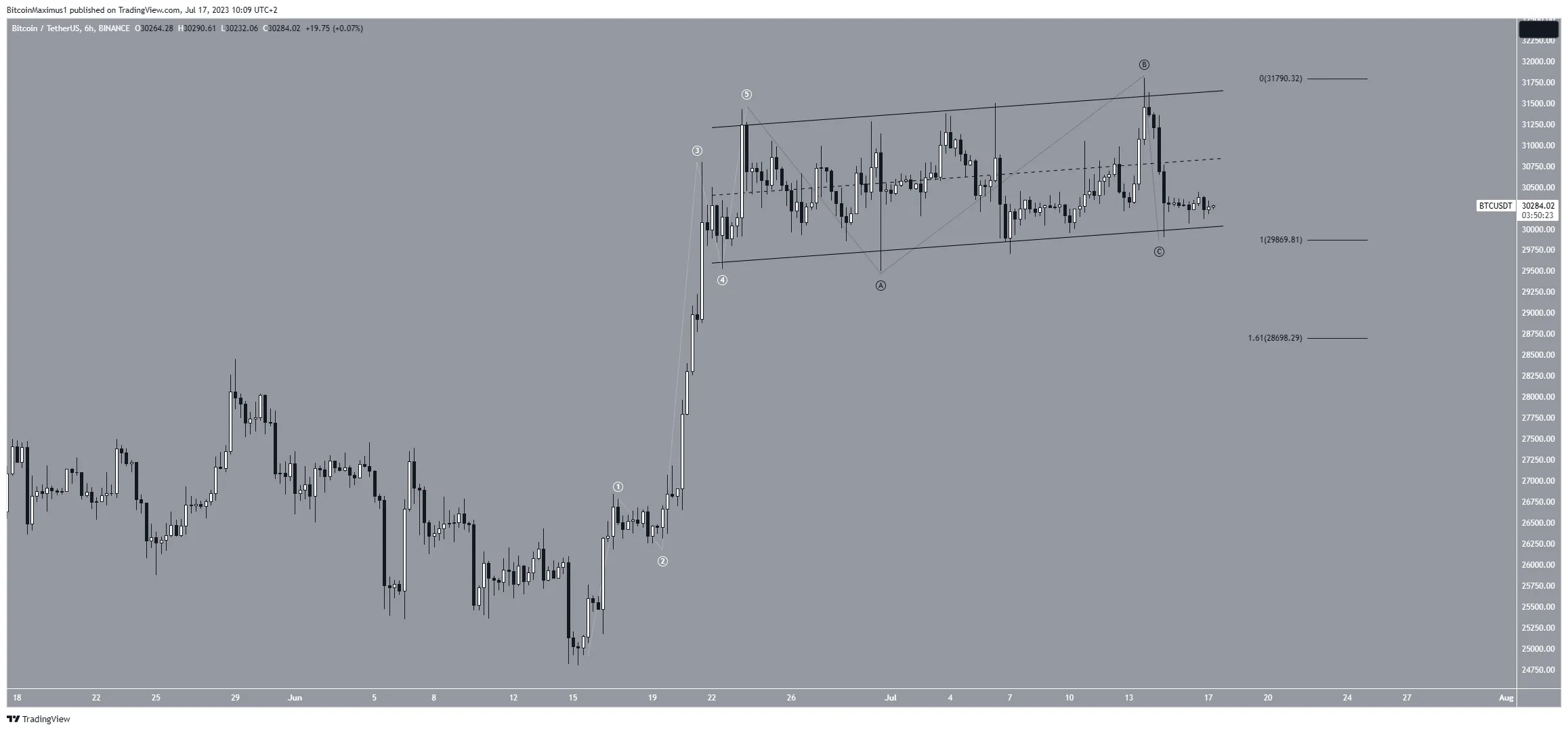

A closer look at the six-hour time frame provides a mixed reading. This is because of the wave count and the price action.p

The wave count suggests that the price completed a five-wave increase (white) since June 14. If the count is correct, it means that the BTC price has been corrected since, in what is likely an A-B-C correction (black).

The fact that the movement has been contained inside an ascending parallel channel makes this possibility more likely.

However, it is not yet clear if the correction is complete. The fact that waves A:C have an exactly 1:1 ratio suggests that the correction could be complete.

However, the fact that the price trades inside an ascending parallel channel indicates that another drop is expected.

Ascending parallel channels are considered corrective patterns, often leading to breakdowns. If a breakdown occurs, the BTC price could fall to the next support at $28,700. This would give waves A:C a 1:1.61 ratio.

Despite this bearish short-term BTC price prediction, moving above the channel’s midline will mean that the correction is complete.

In that case, the BTC price will be expected to break out from the channel and resume its ascent to $35,000.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link